01Existing Customer Data Integration

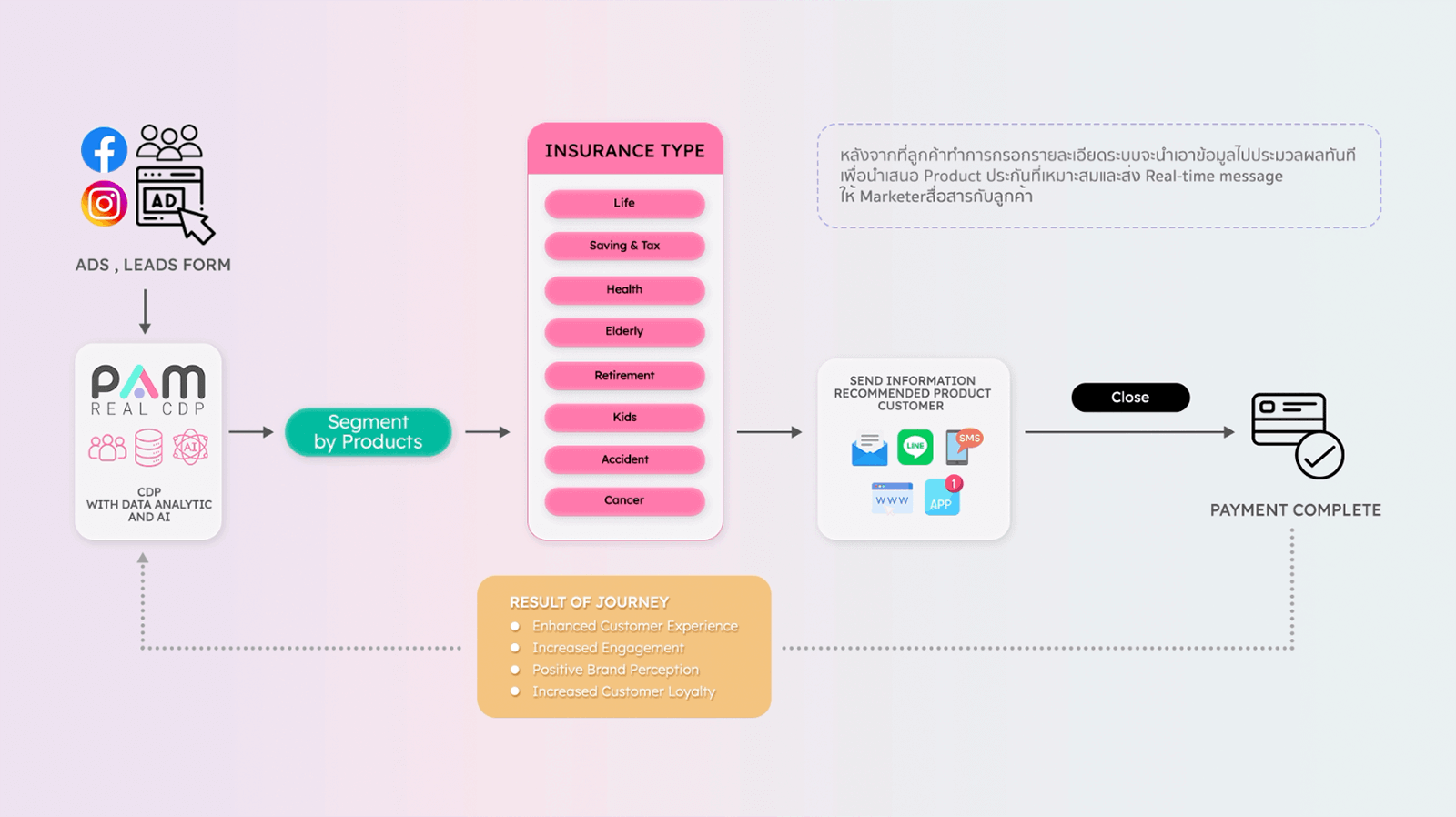

PAM begins by integrating data from existing customers. This includes information about previously purchased insurance types, existing customer data, and payment details. All of this is consolidated into the PAM system.

How PAM Works:

PAM gathers and organizes existing customer data for better accessibility and management.

Benefit for Customers:

Customers enjoy a seamless experience as their previous purchase history and payment details are readily available, reducing the need for repetitive information submission.